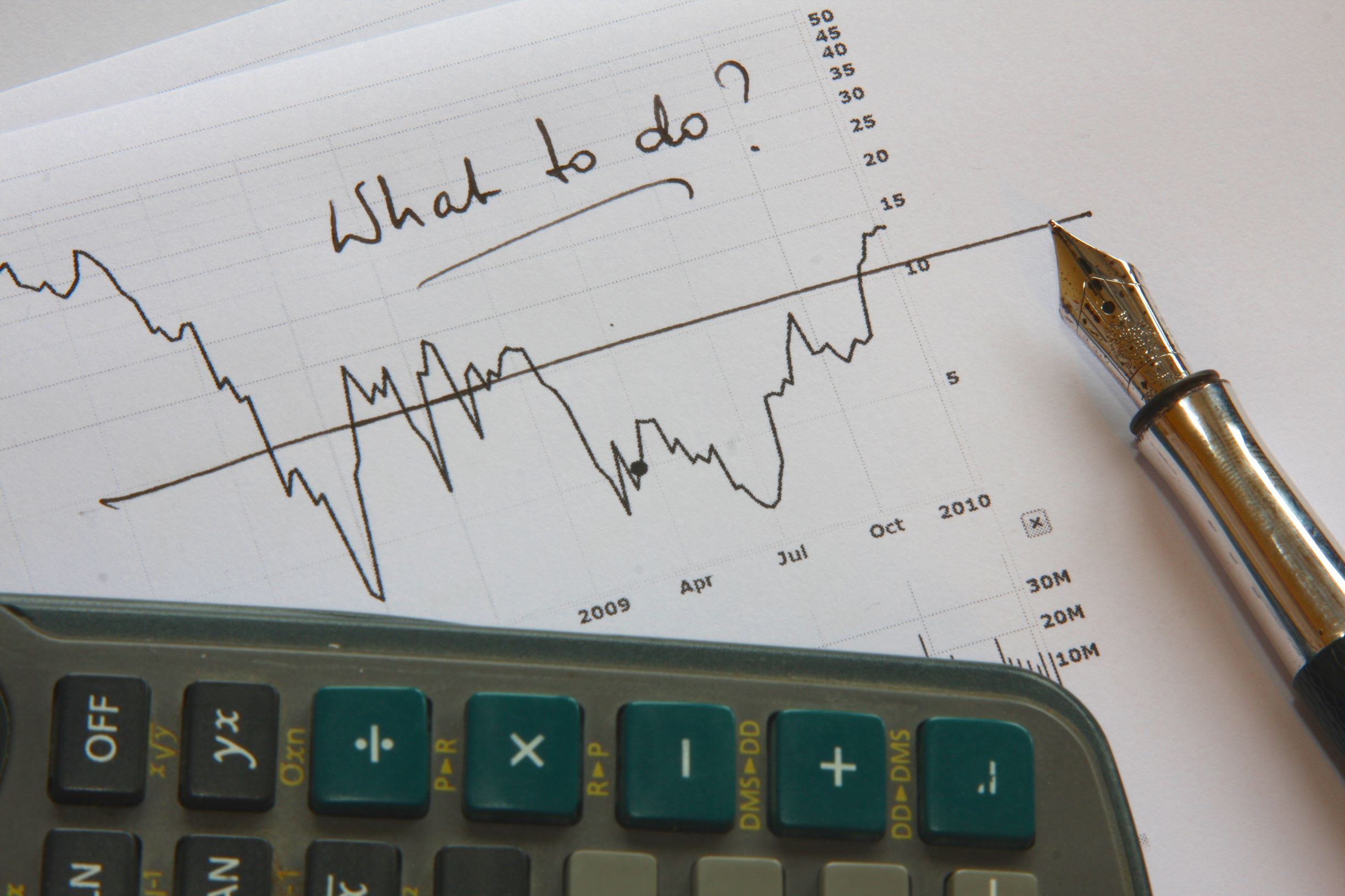

Finance

Financial institutions play a crucial and positive role in the functioning of society. They create wealth for large groups of people, they build and maintain the necessary financial infrastructure all over the world. With this they have an important public function. Constantly, in all that they do, these institutions produce decisions with important moral components, but in most cases are not aware of them. Most of the time they make the right decisions. Sometimes they take morally wrong decisions, and often without knowing they are doing so.

The proper functioning of financial institutions, and of the sector as a whole, requires that they gain a better understanding of what is morally right, what is not, why that is the case and what is necessary in order to act consciously and structurally in a morally right way.

Only then can they regain and maintain the confidence of society in a sustainable manner. Only then will the regulatory burden be reduced. Only then can the huge compliance efforts yield positive returns, and can ultimately be reduced.

Integrity in the financial sector

A financial institution, like other organisations, can be said to have integrity when it is set up to take sufficiently into account the rights and interests of those involved in its actions. Financial institutions are strictly regulated, with rules that also apply to the integrity of their business operations and those of their clients. Much exists already. And financial institutions go to great lengths to meet the requirements.

Nevertheless, things frequently go wrong. In those instances, the institution has not done justice to all those involved, with sometimes major consequences for customers, for society, for the institution itself and for the trust society has in that particular institution as well as in the sector as a whole. The rules cannot ensure that financial institutions structurally take sufficient account of the rights and interests of all parties involved. The institutions must take this responsibility themselves.

G&I has developed a coherent and systematic approach to build and maintain integrity within organisations.

G&I has been supporting organisations for more than 25 years to do justice to all those involved in their operations, both on a regular basis and in crisis situations.

G&I works with financial institutions on two components of an integrity system: the compliance practice and the moral learning process.

Compliance practice

The compliance practice is the whole of governance in the three lines of defense, formal internal and external rules, risk management, and the handling and reporting of compliance violations. The compliance practice has a preventive and a repressive component and is about preventing and responding to violations.

A general observation of the compliance practice of most financial institutions is that they are often overdone yet insufficient at the same time. They are overdone in the sense that there are too many rules and procedures, we can’t see the wood for the trees. And yet they are not sufficient to be able to adequately address the real vulnerabilities of the organisation.

G&I has developed various instruments, such as system analyses, risk analyses and personal risk profiles for board members that are impactful and provide management as well as internal and external supervisory bodies with new insights and solutions.

Moral learning process

The moral learning process is about careful decision-making and has two components: moral judgement and moresprudence (moral knowledge). The first concerns structural moral deliberation on difficult decisions and dilemmas, and the latter concerns moral management information and early warning signs.

A general observation of the moral learning process of most financial institutions is that it is weakly developed: resulting in blind spots for the moral implications of decisions and behavior.

G&I supports organisations by training and supporting directors, executive and supervisory board members and staff to install a moral learning process, facilitating moral deliberations, training in-house facilitators of moral deliberations and analysing the results of moral deliberations into moresprudence.

Governance & Integrity supports banks, insurance companies pension funds and other financial institutions to set themselves up as organisations with integrity. We do that internationally. Alongside that, we work with supervisory bodies and branch organisations in the financial sector.

We aim to work with courageous forerunners, with those who have committed to real change and with organizations in crisis that urgently need help.

Professionals

Moniek Bouland

Director G&I International | Partner G&I

Advisor and trainer

Moniek started her career at PriceWaterhouseCoopers as a Strategic Risk Analyst in the financial sector.

She was involved in the construction and expansion of the Central Organization for Integrity for the Military and has over 15 years of experience as a consultant in the field of integrity, both in the Netherlands and abroad (in particular Belgium, Ukraine and the Caribbean).

Annemiek Louwrier

Advisor and trainer

After more than 20 years in the legal profession, in 2013 Annemiek began advising and training in the field of integrity and professional ethics, and supervising peer reviews. She is convinced that society will benefit if all the stakeholders are sufficiently taken into account at all levels and in all activities.

In addition to litigation, she has been involved in mergers and acquisitions, IPOs and financing. From this background, at G&I she mainly focuses on the legal chain, the financial world, business services and the tax authorities.

Frans Geraedts

Partner G&I

Advisor and trainer

Frans studied philosophy and psychology at the University of Groningen. He advises a large number of municipalities and government bodies on the development of their integrity policy.

As a trainer, he mainly focuses on the governance and management of organizations, and gives the basic course on compliance to higher management.

Aya Polderman

Trainer

Aya is a philosopher and graduated in ethics programs within Dutch banks. During her studies she did an internship with the editorial staff of Het Filosofisch Kwintet of broadcasting company Human.

During the master that followed she taught Ethics to first-year philosophy students as an assistant teacher. She has been working for G&I since early 2019, currently in the position of companion of Frans Geraedts.